Time for the annual review of pharmacy sales activity namely the sold & settled Queensland pharmacies for 2020. What a year 2020 has been, one we will never forget for many reasons. For all of us involved in pharmacy or associated industries and businesses we should be very grateful that we are in pharmacy. Pharmacies on the whole have performed very well during 2020 and showed how resilient and nimble they are, adapting to provide essential services to all Queenslanders in times of natural disaster and global pandemic.

A Look Back

It is always best to begin any review with a look back at what we predicted for pharmacy sales in 2020 in the 2019 market review and see what we got right. We predicted an increase in the number of listings and subsequently an increase in sales between 2019 and 2020 which certainly came true. Amazing that with Covid-19 and periods of lockdown this would have been possible however, it happened in Queensland and other states as well. The main reasons why we saw increased market activity are listed below (Covid-19 is not one of them):

- The 7th Community Pharmacy Agreement (CPA) commenced in July 2020 providing the industry certainty for the next 5 years. Overall the CPA was positive and contained nothing that would adversely impact pharmacies profitability in the longer term;

- The strength and stability of the pharmacy industry was prevalent throughout the challenges of 2020. Remaining open as an essential service when the majority of other businesses were forced to close. Obviously, there are some exceptions with CBD and large shopping centre pharmacies hit hard and some still impacted now;

- Record low interest rates and several large banks maintaining a healthy appetite to grow their pharmacy lending portfolios;

- Investing in pharmacy still provided significantly better return on investment when compared to alternatives such as term deposits, stocks, property etc; and

- Increased buyer activity translated to increased competition when pharmacies are listed and sold on the open market, often resulting in sales prices above the valuations figures. A good time to be a seller.

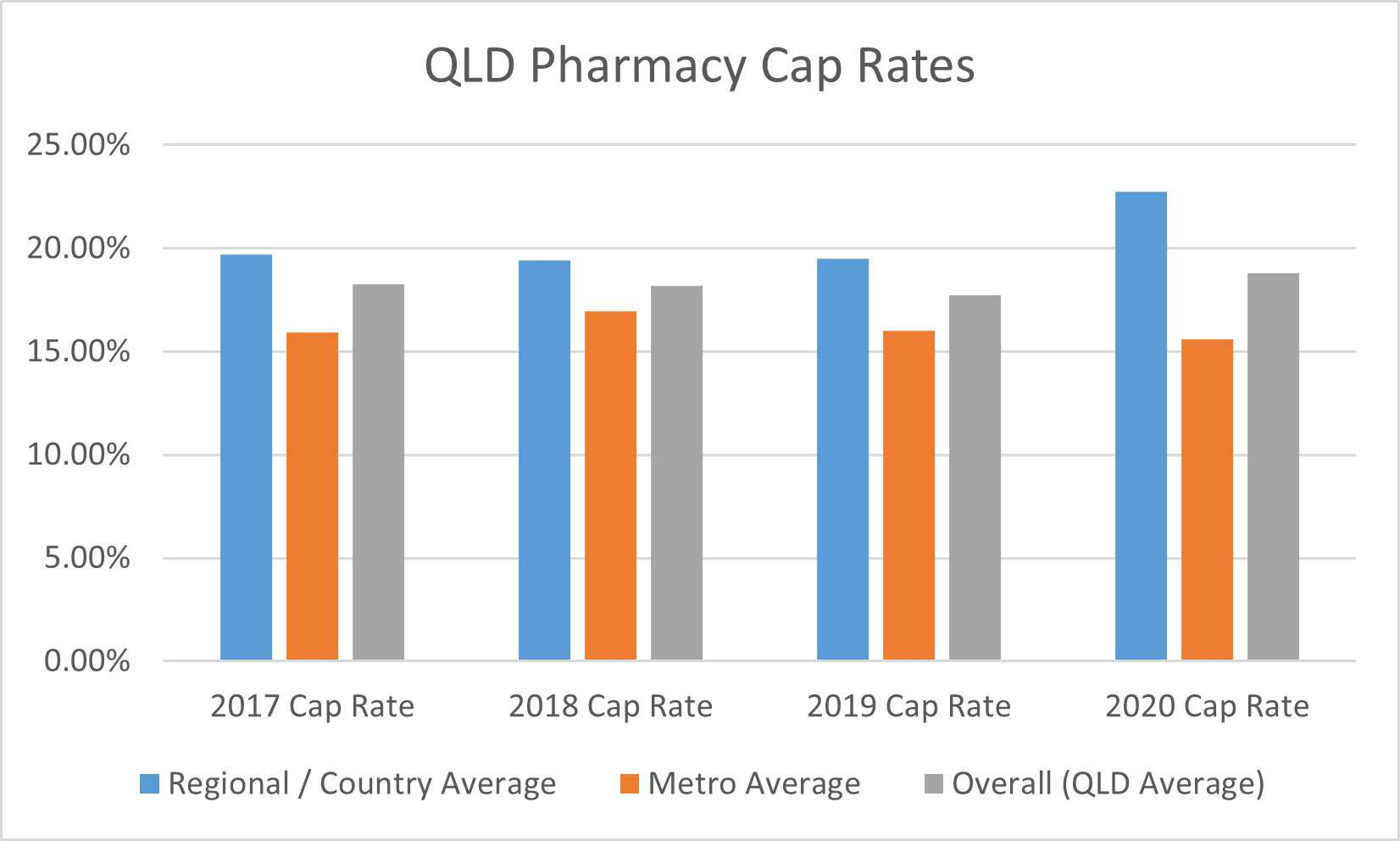

AP Group predicted capitalisation rates would remain steady for metro areas and regional Queensland as these areas remain attractive for pharmacy investments. The average capitalisation rate for metro areas decreased slightly again from 16.0% in 2019 to 15.61% in 2020. This is the third consecutive year this has occurred and it’s likely that this trend will continue into 2021. Demand for pharmacies remained strong in 2020 – in particular, profitable metro pharmacies attracted multiple buyers contributing to the slight reduction in the average capitalisation rate based on the sold price vs valuation.

In regional Queensland the cap rates varied widely with a range from 17.5% to 27% in 2020. The capitalisation rate was heavily influenced by how accessible the particular pharmacy was. Pharmacies located in major regional hubs such as Toowoomba and Townsville were much stronger than Richmond or Moranbah in Central Queensland.

Analysis

| QUEENSLAND | 2020 Cap Rate | 2019 Cap Rate | 2018 Cap Rate | 2017 Cap Rate |

| Regional / Country Average | 22.74% | 19.5% | 19.40% | 19.69% |

| Regional / Country (Range) | 17.5% to 27.2% | N/A | 19.19% to 19.6% | 19.0% to 20.2% |

| Metro Average | 15.61% | 16.0% | 16.96% | 15.94% |

| Metro (Range) | 15.1% to 16.7% | 14.6% to 16.7% | 16.3% to 17.6% | 15.5% to 16.5% |

| Overall (QLD Average) | 18.78% | 17.75% | 18.18% | 18.28% |

Special Notes: If a pharmacy was purchased based on the sum of its assets or to fill a specific individual need of the buyer and was not sold on the traditional FME valuation methodology, those pharmacy sales have been excluded so as not to skew the results.

Observations & Conclusions

Metro (Brisbane, Gold Coast & Sunshine Coast)

It is becoming a recurring theme each year for quality profitable pharmacies in metro areas to attract multiple buyers when listed on the open market resulting in the average capitalisation rate pushing down gradually year on year. This is obviously good news for sellers as market forces drive prices up however it can present an equally good opportunity for buyers as they are still getting access to quality businesses which they can build on and improve over time. For first-time buyers looking to venture into pharmacy ownership there are still plenty of opportunities at the affordable end of the market. Some of these smaller community pharmacies present an excellent opportunity for an owner operator to grow significant value with a fresh approach to the business offer.

Consumer habits definitely changed due to Covid-19 and more people are choosing to shop locally. In addition, it is likely a significant portion of the workforce will continue to work from home well into 2021 changing where they are likely to shop on a daily basis. Local community pharmacies have reported seeing new customers, increased demand for home deliveries and new opportunities to grow revenue which is likely to continue into the foreseeable future.

Regional & Country QLD

Regional QLD seemed like a different country to metro Queensland during the pandemic. Most businesses and the way the public went about their lives seemed mostly unchanged by Covid-19. This presented yet another great reason to consider purchasing a pharmacy in regional Queensland when looking for your next pharmacy business. Many astute pharmacy buyers are looking to increase their portfolios in regional cities and towns, with average capitalisation rates of 19% – 20% compared with 15% – 16% for metro pharmacies, you can understand why. Groups that operate both metro & regional pharmacies often comment their regional pharmacies are more profitable than their metro stores. The main limiting factor is finding owner operators or pharmacists, however this is often overcome by offering managing partnerships in these regions. Those that do tend to thrive!

Predictions for 2021

I think the current level of market activity, new listings and sales will continue into 2021, maybe even increase slightly. The positivity around the pharmacy industry will likely continue and with the ink barely dry on the 7th CPA we are likely to see continued high levels of buyer confidence fueling the strong market. The government at both state and federal levels are likely to provide incentives to stimulate the economy which could potentially filter through to pharmacy as well. With interest rates at record low levels and likely to stay that way for some time according to the Reserve Bank it is becoming difficult to find reasons not to buy a pharmacy right now. When a Covid-19 vaccine is approved (before the end of 2020 according to some reports), we could see a massive revenue injection for pharmacies as they will likely play an important role in administering the vaccine to the population.

It is likely Queensland capitalisation rates will hold roughly the same in 2021 though we could see a slight decrease again in metro capitalisation rates however, that will be influenced by the quality of the listings which come to market. Demand for pharmacy opportunities will likely remain high across all price ranges as it is almost always stronger than the supply available. Metro pharmacies continue to be highly sought after and present difficulty for first-time buyers trying to acquire as they can find themselves competing with large groups. One way to circumvent this is to look for Managing Partner opportunities which can be a good option for young pharmacists looking to get into pharmacy ownership as the groups and multi store owners keep growing. If you wish to discuss any of the views, opinions or observations expressed in this article please feel free to reach out to me directly. Looking forward to 2021 and hopefully AP Group can assist you along your pharmacy ownership journey.

– Ian Fedrick, Partner and QLD Sales Manager at AP Group