As we close in on another calendar year, it’s time for the annual review of Queensland pharmacy sales activity in 2021. In this review, we look at indicators like capitalisation rates for metro and regional areas, average percentage above valuation and number of transactions compared to the previous year’s data. On the whole, community pharmacies have had another good year, with some exceptions being pharmacies in capital city CBD’s and large shopping centres, which are still not back to pre-Covid levels of trade.

A Look Back

It’s always good to look back at last year’s predictions to see if what we thought would happen in 2021 – regarding pharmacy sales cap rates and level of activity – came true or not. The number of sales and listings continued to be strong, with a slight increase in the second half of 2021 as evident on our AP Group website. The high level of buyer confidence in pharmacy continued, fuelling a number of fantastic results for vendors in 2021.

- Interest rates remain at record low levels and will likely stay there for some time.

- Covid-19 has not gone away. We now have to live with it and community pharmacies continue to play an important role, administering Moderna, Pfizer and AstraZeneca vaccinations.

- The strength and stability of the pharmacy industry throughout the covid-19 lockdowns has further improved confidence that community pharmacy is a good investment.

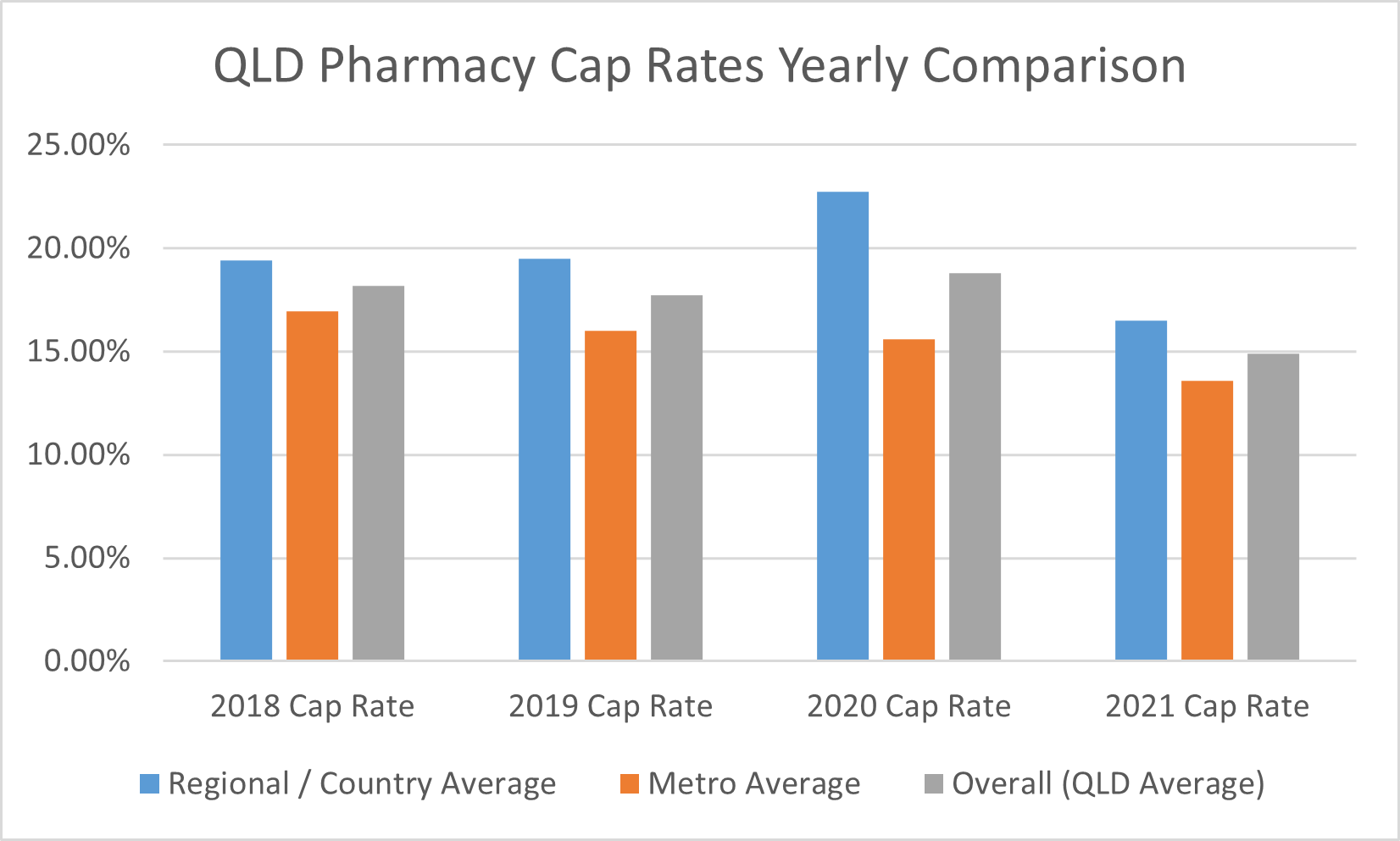

As for Queensland cap rates in 2021, well the numbers don’t lie. The average cap rates in metro and regional areas dropped by over 2% compared to 2020 (I didn’t see that coming). This year, quality community pharmacy listings were highly sought after on the open market, resulting in never seen before cap rates for the QLD market.

Competitive conditions for first time buyers to break into the market continues. However, an interesting fact: this year 40% of pharmacies sold in QLD were to individual pharmacists (non-groups). Single pharmacy towns in small and remote regions provided a challenge to find buyers in 2021. That could be due to the border closures during covid-19, restricting pharmacists’ movements as well as the shortage of pharmacists across the country.

Analysis

| QUEENSLAND | 2021 Cap Rate | 2020 Cap Rate | 2019 Cap Rate | 2018 Cap Rate |

| Regional / Country Average | 16.5% | 22.74% | 19.5% | 19.40% |

| Regional / Country (Range) | 13.9% to 18.9% | 17.5% to 27.2% | N/A | 19.19% to 19.6% |

| Metro Average | 13.59% | 15.61% | 16.0% | 16.96% |

| Metro (Range) | 12% to 16.15% | 15.1% to 16.7% | 14.6% to 16.7% | 16.3% to 17.6% |

| Overall (QLD Average) | 14.88% | 18.78% | 17.75% | 18.18% |

Special Notes: If a pharmacy was purchased based on the sum of its assets or just the PBS approval number and was not sold using the traditional FME valuation methodology, it has been excluded to avoid skewing the results.

Regional / Country: (all other parts of QLD)

Observations & Conclusions

Average Sale Price in QLD = $1.72M

Average Sold Price Above Valuation = 20.5%

Metro: The recurring theme of quality pharmacies in metro areas attracting multiple buyers and driving the average cap rate down kicked into overdrive this year. A 2% decrease in the cap rate compared to 2020 took it to 13.59% – which is amazing. One factor that’s contributing to this surge in prices for metro community pharmacies is the diminishing supply. QLD has several large independent groups (non-banner groups) that have been growing and buying pharmacies for a decade now (and they rarely sell, only buy). This has created a smaller pool of possible independent pharmacies for sale as the rest are tightly held by groups. This has been good news for sellers that go to the open market, as seen in the results this year.

Smaller community pharmacies which sold for around $1M were the entry point for first time buyers, representing 40% of sales in QLD. These small, local community pharmacies aren’t usually on the radar of larger groups, as they need a hands-on owner operator with drive and fresh ideas to improve the business and add significant value over time. Consumer habits shifting toward shopping local has been embedded now, with the increased turnover seen by many community pharmacies in 2020 continued in 2021.

Regional & Country QLD: The longer term cap rate for regional QLD has been hovering around 19.5%. So a 3% decrease to 16.5% average in 2021 is reflective of the broader market. There are a few other contributing factors when we looked at those sales more closely compared to other years:

- The sample of regional and country pharmacies sold in 2021 did not include any small, single pharmacy towns that would push the average cap rate higher than the trending average (for example, above 20%). The pharmacies sold were in large regional cities on the coast.

- A couple of the groups I mentioned that are continuing to buy in metro are now targeting larger regional cities in North QLD for acquisitions. They’re doing this for a few reasons: opportunities in metro areas are decreasing and cap rates are more appealing, even at 16.5% average.

- The increased competitive market forces between buyers is now occurring in regional cities, driving prices up and cap rates down. The existence of multiple buyers for a pharmacy in a regional town was rare in earlier years.

Predictions for 2022

Well 2021 was an amazing year for pharmacies sold, with never seen before cap rates for the QLD market.

Will that continue in 2022? I think so, as there are no signs the market activity or external influences will be any different in 2022 to this year.

- Interest rates are likely to stay at record low levels as the Reserve Bank has kept the cash rate unchanged at 0.10%.

- Covid-19 is not going away, we now have a new variant ‘Omicron’ emerging. But on the whole, pharmacy has flourished during the Covid years and is better positioned now pharmacists can administer all available Covid vaccinations.

- There are still a large number of buyers active in the market, looking for quality community pharmacies in metro and major regional cities.

As multi-store owners and independent groups that are buying and expanding look at their options to lock in talented pharmacists, we might see an increase in the number of working managing partnership opportunities on offer in 2022. The current pharmacist shortage will continue as there are no quick fixes. Consequently, there are positive signs for those young pharmacists with ambition and determination to become a pharmacy owner or working managing partner.

If you wish to discuss any of the views, opinions or observations expressed in this article please feel free to contact me directly at ian@apgroup.com.au

I am looking forward to 2022 and hopefully AP Group can assist you along your pharmacy ownership journey.

– Ian Fedrick, Partner and QLD Sales Manager at AP Group